san francisco sales tax rate history

1000000 or more but less than 5000000. We seek to transform the way the City works through the use of data.

California City County Sales Use Tax Rates

The minimum combined 2022 sales tax rate for San Francisco California is.

. Rate County Acampo. California CA Sales Tax Rates by City A The state sales tax rate in California is 7250. We believe use of data and evidence can improve our operations and the services we provide.

DataSFs mission is to empower use of data. California has a 6 sales tax and San Mateo County collects an additional 025 so the minimum sales tax rate in San Mateo County is 625 not including any city or special district taxes. Type an address above and click Search to find the sales and use tax rate for that location.

5 digit Zip Code is required. Presidio San Francisco 8625. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar.

Select the California city from the list of cities starting with A below to see its current sales tax rate. In San Francisco the tax rate will rise from 85 to 8625. Did South Dakota v.

Ad Find Out Sales Tax Rates For Free. This is the total of state county and city sales tax rates. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

Fast Easy Tax Solutions. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco. The average sales tax rate in California is 868.

These transactions had previously been taxed at the 075 rate. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax.

California has recent rate changes Thu Jul 01 2021. Ad Find Out Sales Tax Rates For Free. Anaheim 7750 Orange Anderson 7750.

Depending on the zipcode the sales tax rate of san francisco may vary. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in. The San Francisco sales tax rate is.

For tax rates in other cities see. The California sales tax rate is currently. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35.

City Rate County American Canyon 7750. Angels Camp 7250 Calaveras. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note.

Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625. Next to city indicates incorporated city City. 4 rows The current total local sales tax rate in San Francisco CA is 8625.

The County sales tax rate is. With local taxes the total sales tax rate is between 7250 and 10750. Proposition N passed in November 2010 created a new tax rate of 25 for transactions greater than or equal to 10 million and increased the tax rate on transactions of 5 million to 10 million from 15 to 20.

The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. The 200 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 925 725 statewide tax rate plus the 200 tax rate cap. This ultimately leads to increased quality of life and work for San Francisco residents employers employees and visitors.

Presidio of Monterey Monterey 9250. The December 2020. As of April 1 2022 the following 140 California local jurisdictions have a combined sales tax rate in excess of the 200 percent local tax rate cap.

What is the sales tax rate in San Francisco California. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. Concord 875 San Mateo County TBA 050 November 2018 ballot San Diego 775 Daly City 875 Denver 765 Redwood City 875 Miami 700 San Francisco 850 Boston 625 Walnut Creek 825 Washington DC 575 SourceNotes CURRENT Bay Area Sales Tax Rates and 2017 Sales Tax Ballot Measures1 ProposedEnacted Changes in Sales Tax Change in Sales Tax Rate.

You can print a 9875 sales tax table here. There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The San Francisco Tourism Improvement District sales tax has been. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer Tax Collector Office. The San Francisco County California.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles. The tax rate given here will reflect the current rate of tax for the address that you enter. The San Francisco County Sales Tax is 025.

Historical Tax Rates in California Cities Counties. The highest sales tax in the state is Santa Fe Springs a LA County city with a rate of 1050 percent. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

Average Sales Tax With Local. 6 rows Download all California sales tax rates by zip code. Please ensure the address information you input is the address you intended.

Learn about the Citys property taxes. This table shows the total sales tax rates for all cities and towns in San.

Frequently Asked Questions City Of Redwood City

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

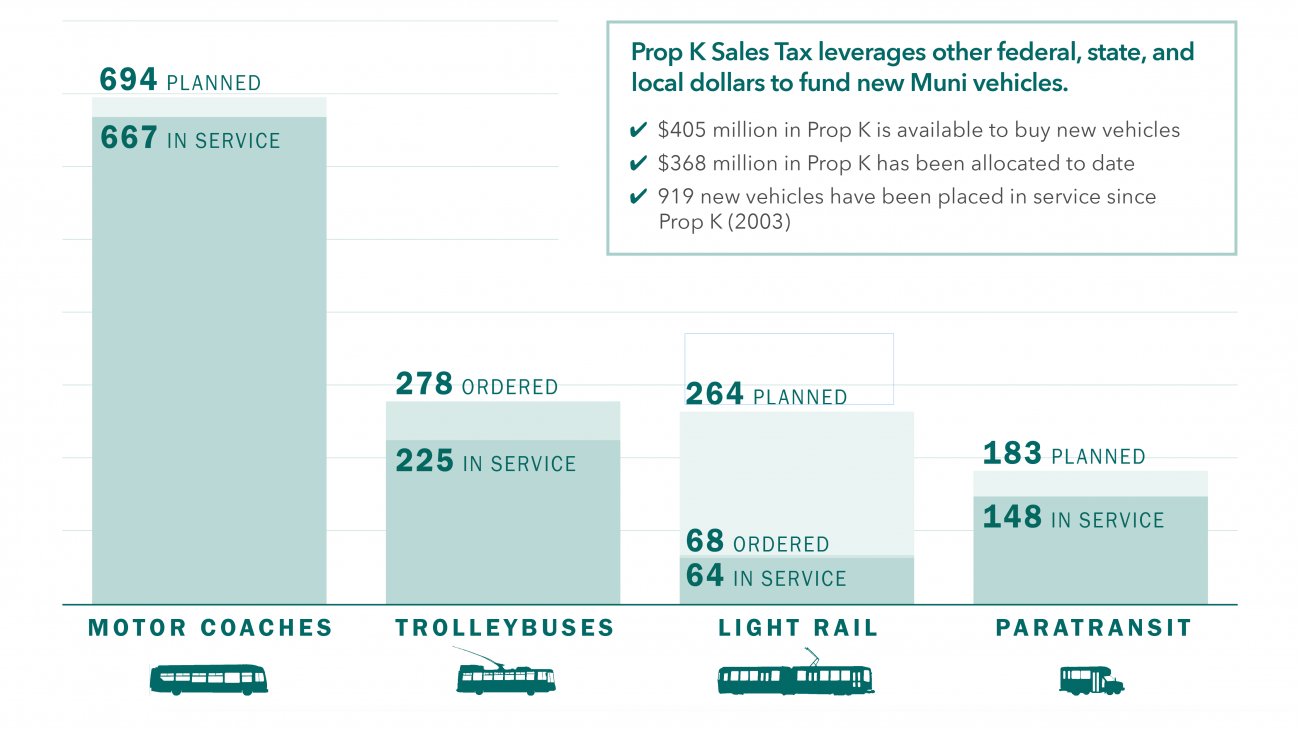

The Bay Area Today Plan Bay Area 2040 Final Plan

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

States With Highest And Lowest Sales Tax Rates

California Taxpayers Association California Tax Facts

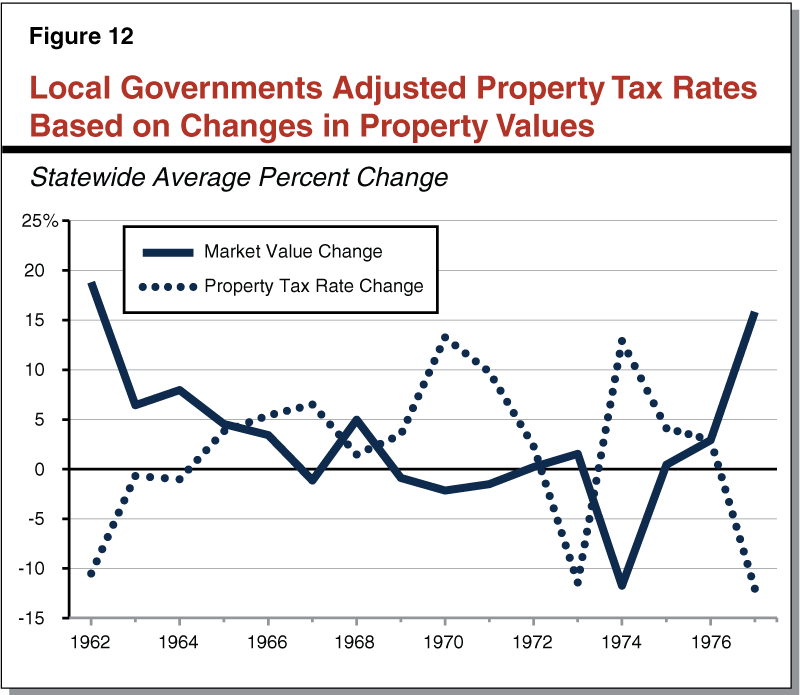

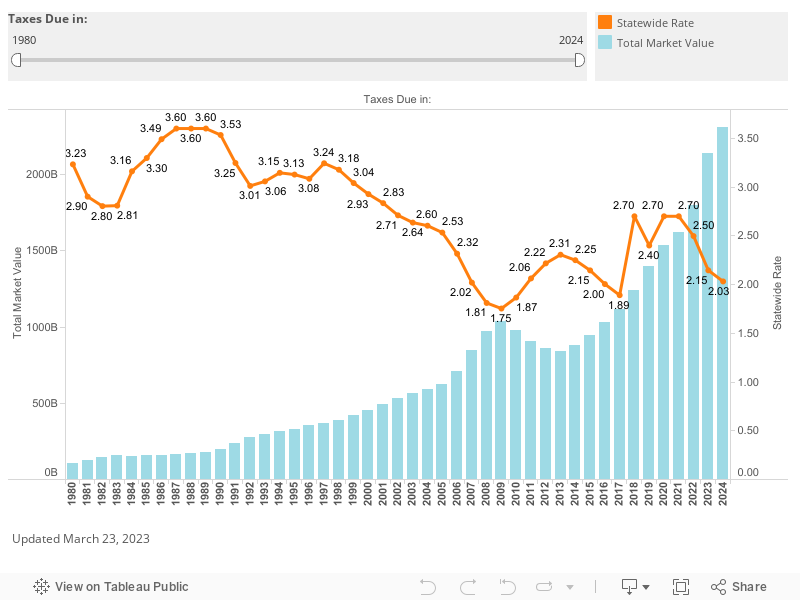

Common Claims About Proposition 13

Sales Tax Collections City Performance Scorecards

How Do State And Local Sales Taxes Work Tax Policy Center

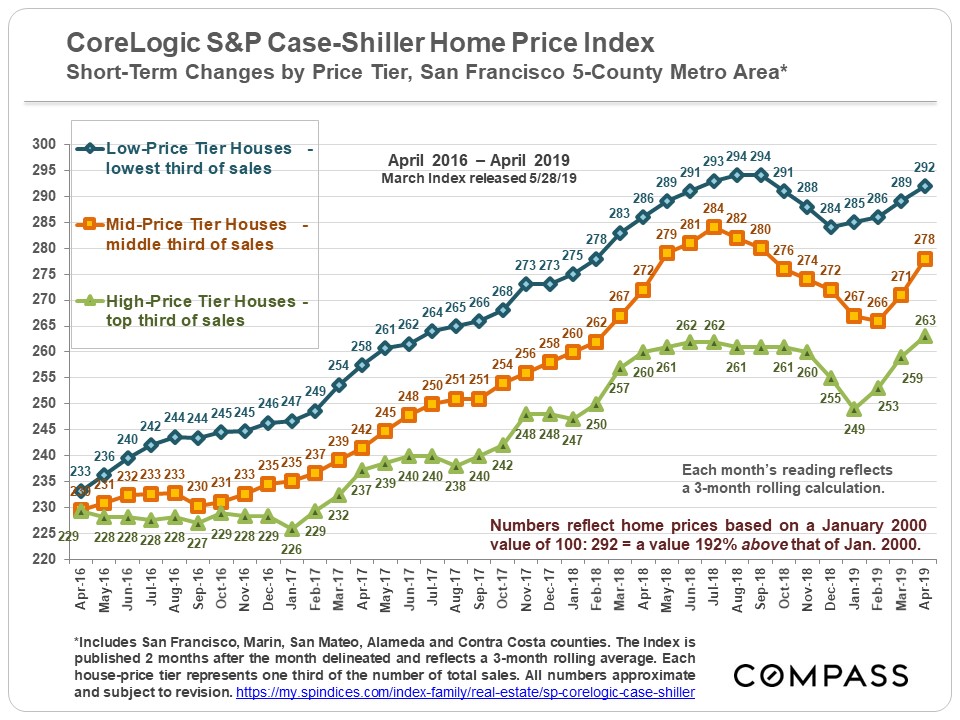

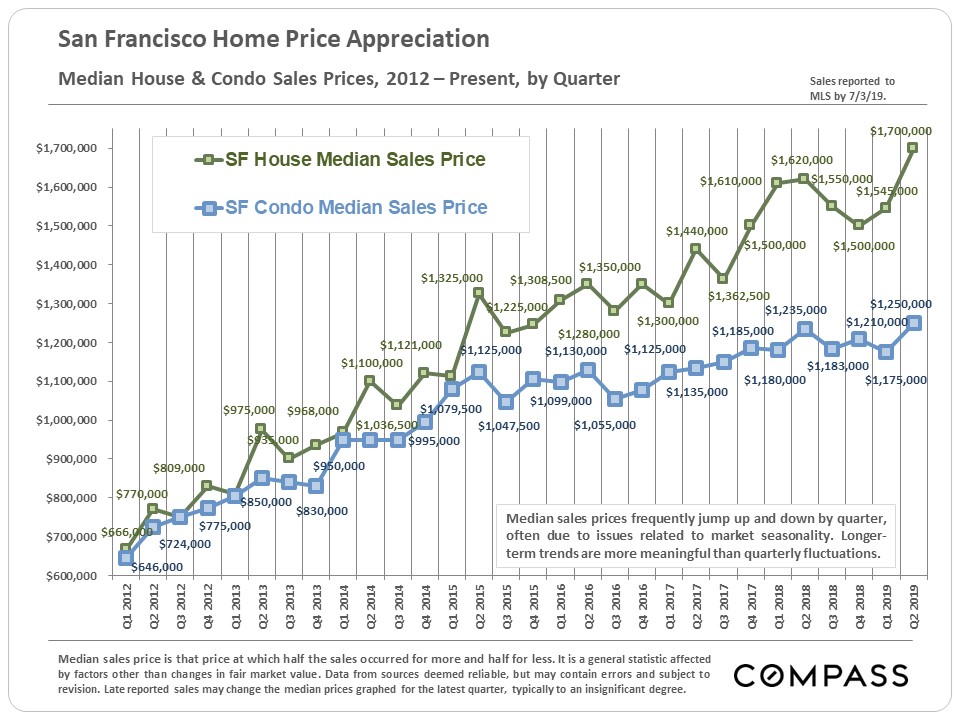

30 Years Of Bay Area Real Estate Cycles Compass Compass

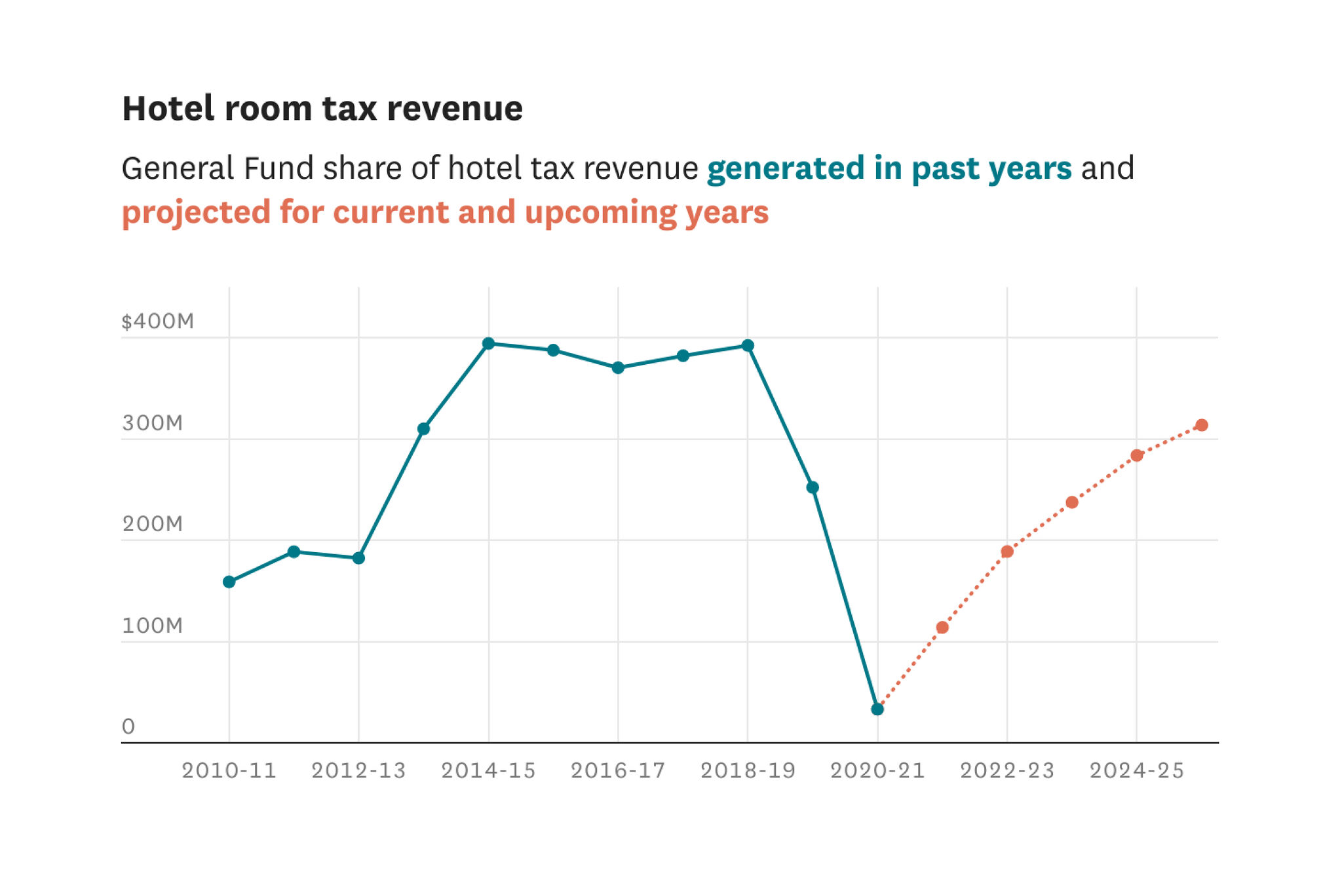

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

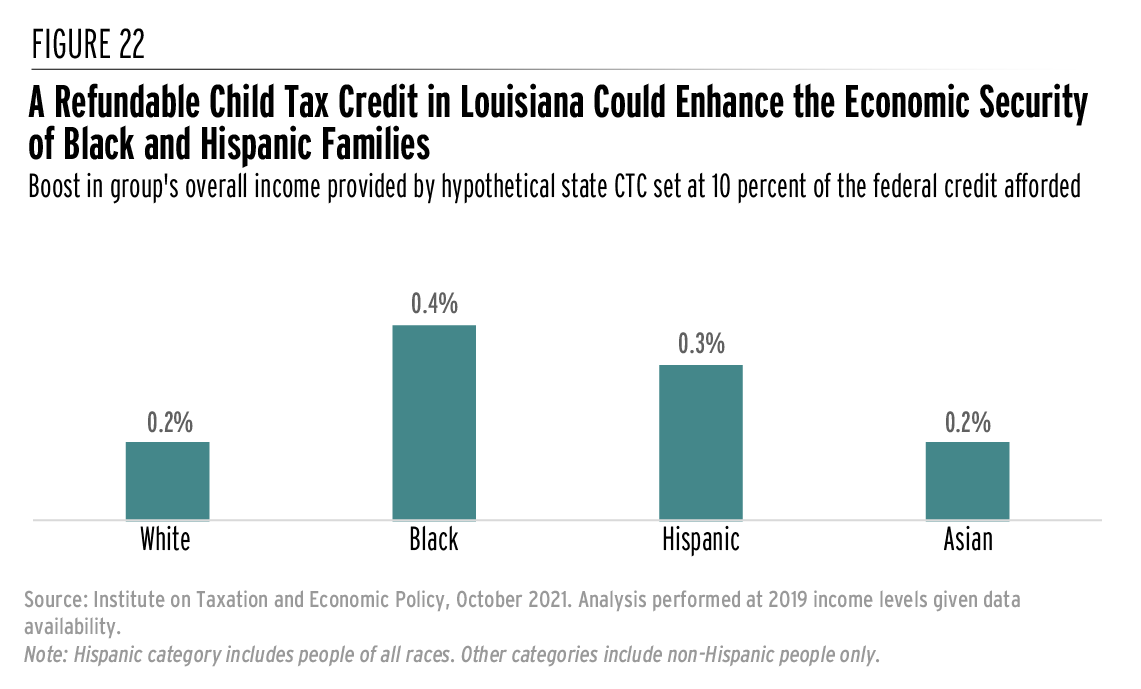

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How Do State And Local Sales Taxes Work Tax Policy Center

Property Tax History Of Values Rates And Inflation Interactive Data Graphic Washington Department Of Revenue

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

California Sales Tax Rates By City County 2022